Exploring Lucrative Energy Trader Jobs in the UK

The World of Energy Trader Jobs

Energy trader jobs play a crucial role in the dynamic and fast-paced energy industry. These professionals are responsible for buying and selling energy commodities, such as electricity, natural gas, oil, and renewable energy credits, with the goal of generating profits for their companies.

Energy traders closely monitor market trends, analyse data, and make strategic decisions to capitalise on price fluctuations. They must have a deep understanding of the energy markets, economic factors, geopolitical events, and regulatory changes that can impact prices.

Skills Required for Energy Trader Jobs

Successful energy traders possess a unique set of skills that enable them to thrive in this challenging field. These skills include:

- Strong analytical abilities

- Risk management expertise

- Excellent decision-making under pressure

- Financial acumen

- Effective communication skills

- Adaptability to changing market conditions

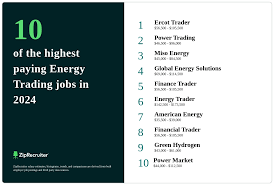

Career Opportunities in Energy Trading

The energy trading sector offers diverse career opportunities for professionals with a passion for finance, economics, and the energy industry. Some common job titles in this field include:

- Energy Trader

- Risk Analyst

- Market Analyst

- Quantitative Analyst

- Compliance Officer

- Portfolio Manager

- Derivatives Trader

The Future of Energy Trading

In an ever-evolving energy landscape marked by technological advancements and sustainability goals, energy trading continues to be a critical function in ensuring efficient energy markets. As renewable energy sources gain prominence and carbon pricing mechanisms evolve, the role of energy traders will become even more vital in facilitating the transition to a cleaner and more sustainable future.

If you are passionate about finance, have a keen interest in the energy sector, and thrive in a fast-paced environment, exploring a career in energy trading could be an exciting and rewarding path for you.

8 Essential Tips for Excelling in Energy Trader Roles

- Stay updated on market trends and news

- Develop strong analytical skills

- Understand risk management techniques

- Build a network within the industry

- Be adaptable to changing market conditions

- Consider further education or certifications in finance or energy trading

- Stay informed about regulatory changes affecting the energy sector

- Practice good communication skills for negotiations and relationship building

Stay updated on market trends and news

To excel in energy trader jobs, it is essential to stay updated on market trends and news. Keeping a keen eye on the latest developments in the energy sector, such as regulatory changes, geopolitical events, and technological advancements, can provide valuable insights for making informed trading decisions. By staying informed and proactive in monitoring market trends, energy traders can adapt to changing conditions swiftly and seize opportunities to maximise profits while managing risks effectively.

Develop strong analytical skills

Developing strong analytical skills is essential for success in energy trader jobs. As professionals in this field are tasked with monitoring market trends, interpreting complex data, and making strategic decisions to maximise profits, the ability to analyse information effectively is paramount. By honing their analytical skills, energy traders can gain valuable insights into market dynamics, identify opportunities for profitable trades, and mitigate risks more efficiently. Strong analytical capabilities enable energy traders to navigate the complexities of the energy markets with confidence and precision, ultimately contributing to their success in this dynamic and competitive industry.

Understand risk management techniques

Understanding risk management techniques is a fundamental aspect of excelling in energy trader jobs. Energy markets can be volatile and unpredictable, making it essential for professionals in this field to mitigate risks effectively. By mastering risk management techniques, such as diversification, hedging, and scenario analysis, energy traders can safeguard their portfolios against potential losses and maximise their chances of success. A thorough understanding of risk management not only enhances decision-making but also instils confidence in navigating the complexities of the energy trading landscape.

Build a network within the industry

Building a network within the energy trading industry is a valuable tip for aspiring energy traders. Networking allows individuals to connect with professionals already established in the field, providing opportunities for mentorship, knowledge sharing, and potential job openings. By attending industry events, joining online forums, and engaging with peers in the sector, aspiring energy traders can gain insights, expand their knowledge base, and increase their chances of success in this competitive field. Networking not only helps individuals stay informed about market trends but also opens doors to new possibilities and collaborations within the dynamic world of energy trading.

Be adaptable to changing market conditions

In the realm of energy trader jobs, it is crucial to be adaptable to changing market conditions. The energy markets are highly volatile and subject to various external factors that can influence prices and demand. Traders who can quickly assess and respond to these fluctuations have a competitive edge. Being adaptable allows energy traders to pivot strategies, seize opportunities, and mitigate risks effectively in dynamic market environments. Embracing adaptability is key to navigating the complexities of energy trading and achieving success in this challenging yet rewarding field.

Consider further education or certifications in finance or energy trading

For those aspiring to excel in energy trader jobs, it is highly beneficial to consider pursuing further education or obtaining certifications in finance or energy trading. These additional qualifications can provide a deeper understanding of financial markets, risk management strategies, and energy market dynamics, thereby enhancing one’s skills and credibility in the field. By investing in continuous learning and professional development, individuals can stay ahead of the curve and increase their competitiveness in the competitive world of energy trading.

Stay informed about regulatory changes affecting the energy sector

Staying informed about regulatory changes affecting the energy sector is crucial for energy traders to navigate the market successfully. Regulations play a significant role in shaping energy prices and market dynamics, making it essential for traders to stay abreast of any new policies, legislation, or directives that could impact their trading strategies. By staying informed and understanding how regulatory changes can influence energy markets, traders can make more informed decisions and adapt their approaches to mitigate risks and seize opportunities in this ever-changing industry.

Practice good communication skills for negotiations and relationship building

In the realm of energy trader jobs, honing excellent communication skills is paramount for successful negotiations and fostering strong relationships within the industry. Effective communication not only aids in conveying complex ideas and strategies clearly but also plays a crucial role in building trust and rapport with clients, colleagues, and stakeholders. By practising good communication skills, energy traders can enhance their ability to navigate the intricacies of the market, negotiate favourable deals, and establish long-lasting partnerships that are key to sustained success in the dynamic world of energy trading.